Things To Know When Buying Slum Rehabilitation Authority Flats

The efforts by the Maharashtra government to provide a quality life to slum dwellers of Mumbai started since as early as 1971. With the formation of the Slum Rehabilitation Authority (SRA) in 1996, the endeavour received a new direction that involved redevelopment projects and relocation of the inhabitants. The state government has launched a comprehensive slum rehabilitation scheme by introducing an innovative concept of using land as a resource and allowing incentive floor space index (FSI) in the form of tenements for sale in the open market.

MakaaniQ brings some facts and information on investment in SRA flats:

About SRA flats

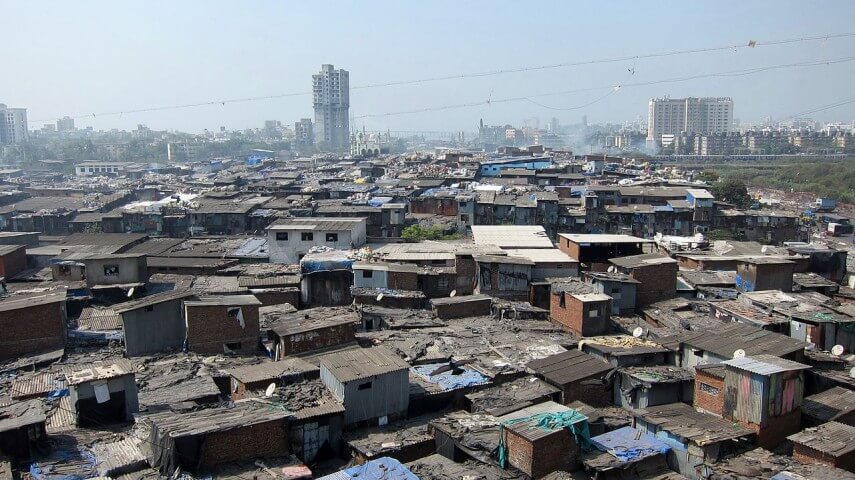

The SRA estimates that over 62 lakh people, amounting to 50 per cent of the city’s population, live in 12.5 lakh slum tenements, collectively spread over just 8 per cent of Mumbai’s geographical area. Migration of employment-seeking people to this big city, over the years, had resulted in the development of such informal, cramped settlements faced with deplorable living conditions like lack of water and electricity. The scheme introduced by the government not only promises a better life for the society’s deprived section but has also attracted property developers and buyers.

A rehabilitation project or SRA project is initiated after all the stakeholders provide consent and notify the government to undertake the project. For relocating the slum dwellers, new housing units or SRA flats are built by private developers, appointed by the government through bid.

Constructions in SRA projects are of two kinds:

- Owner's component - Where a slum-inhabitant surrenders his or her existing home in return for a new unit sized 300 sqft.

- Builder's component - Where the remaining portion is bought by the builder for free-sale, who can further sell these units to buyers for recovering the cost of construction.

The SRA lays down some rules and regulations for these flats:

- Once the beneficiaries get the possession of the flats after the construction, they cannot sell the property for 10 years, which is the lock-in period - applicable to the developers as well.

- After the lock-in period is over and when the dweller wishes to sell the property; then the state government is entitled to its share in the sale price. This is called transaction fee which is equivalent to the maximum stamp duty on the property or Rs 1 lakh, whichever is more.

- The buyers or their family members should not own a house within the corporation's limit. The buyer or the original seller is not allowed to buy any SRA flat. They must submit domicile certificates for the purchase.

- Partnership firms or institutions are not permitted to buy SRA flats. A buyer must belong to the economically weaker section, lower income group and middle-income group.

Home loan for SRA flats

Buyers of SRA flats are eligible for home loans. However, banks fund the purchase of such flats only when the lock-in period is over and all necessary approvals from concerned authorities have been obtained.

The home loan for SRA flats is considered as any other home loan and is processed only after thorough technical and legal due-diligence like any outstanding loan from any other bank or financial institution. Moreover, an approval from the SRA Authority is mandatory.

Things to remember

The SRA housing schemes have attracted many buyers who have been looking for homes in Mumbai. However, one has to be cautious of the risks involved in buying such properties.

- Experts have pointed out that about one-third of the total units have been occupied illegally.

- Some buyers do not have proper documentation while some others resort to renting out their properties for profits, soon after possession on the basis of power of attorney rather than sale deed. This is a violation of the SRA norms. In such a case, both the parties sign a mutual understanding affidavit, however, they are not eligible for home loan because of its legal status.

- It is important to check property title deed, denoting the ownership of the property which should be in the name of the rightful seller. Consult a lawyer.

- The seller should have obtained the release certificate from the bank. This is vital in proving that all dues have been cleared by the seller.